Sezzle virtual card has become increasingly popular among online shoppers looking for flexible payment options. This digital payment method allows users to split their purchases into interest-free installments, making it an attractive choice for those who want to manage their finances effectively. If you're considering using Sezzle, it's important to know which merchants and platforms accept this payment method.

In today's fast-paced world, convenience and flexibility are key factors when it comes to online shopping. Many consumers are turning to buy-now-pay-later (BNPL) services like Sezzle to simplify their purchasing process. Understanding where you can use your Sezzle virtual card ensures that you maximize its benefits while enjoying seamless transactions.

This article will provide a detailed overview of who accepts Sezzle virtual card, including major retailers, e-commerce platforms, and other businesses. By the end of this guide, you'll have a clearer picture of how Sezzle works and where you can utilize it for your shopping needs.

Read also:P Diddy Arrested The Shocking Truth Behind The Headlines

Table of Contents

- What is Sezzle?

- How Does Sezzle Work?

- Who Accepts Sezzle Virtual Card?

- Major Retailers Accepting Sezzle

- E-commerce Platforms That Accept Sezzle

- International Acceptance of Sezzle Virtual Card

- Benefits of Using Sezzle Virtual Card

- Limitations and Considerations

- Statistics and Trends in BNPL

- Conclusion

What is Sezzle?

Sezzle is a buy-now-pay-later (BNPL) service that allows shoppers to split their purchases into four equal, interest-free installments over six weeks. Unlike traditional credit cards, Sezzle does not charge interest or late fees, making it an appealing option for budget-conscious consumers. The service is designed to promote responsible spending while offering flexibility in payment.

Sezzle operates through partnerships with retailers and e-commerce platforms. When you shop at a participating merchant, you can choose to pay with Sezzle during checkout. The platform acts as an intermediary, covering the full purchase amount upfront and allowing you to repay the amount in manageable installments.

How Does Sezzle Work?

Using Sezzle is straightforward and user-friendly. Below is a step-by-step guide on how the service works:

Step-by-Step Process

- Sign Up: Create an account on Sezzle's website or app. You'll need to provide basic information, such as your name, address, and payment details.

- Shop at Participating Merchants: Browse for products at retailers that accept Sezzle as a payment method. Look for the Sezzle logo during checkout.

- Choose Sezzle at Checkout: Select Sezzle as your payment option. The platform will verify your eligibility and process the transaction.

- Repay in Installments: Pay the total amount in four equal installments over six weeks. Payments are automatically deducted from your linked payment method.

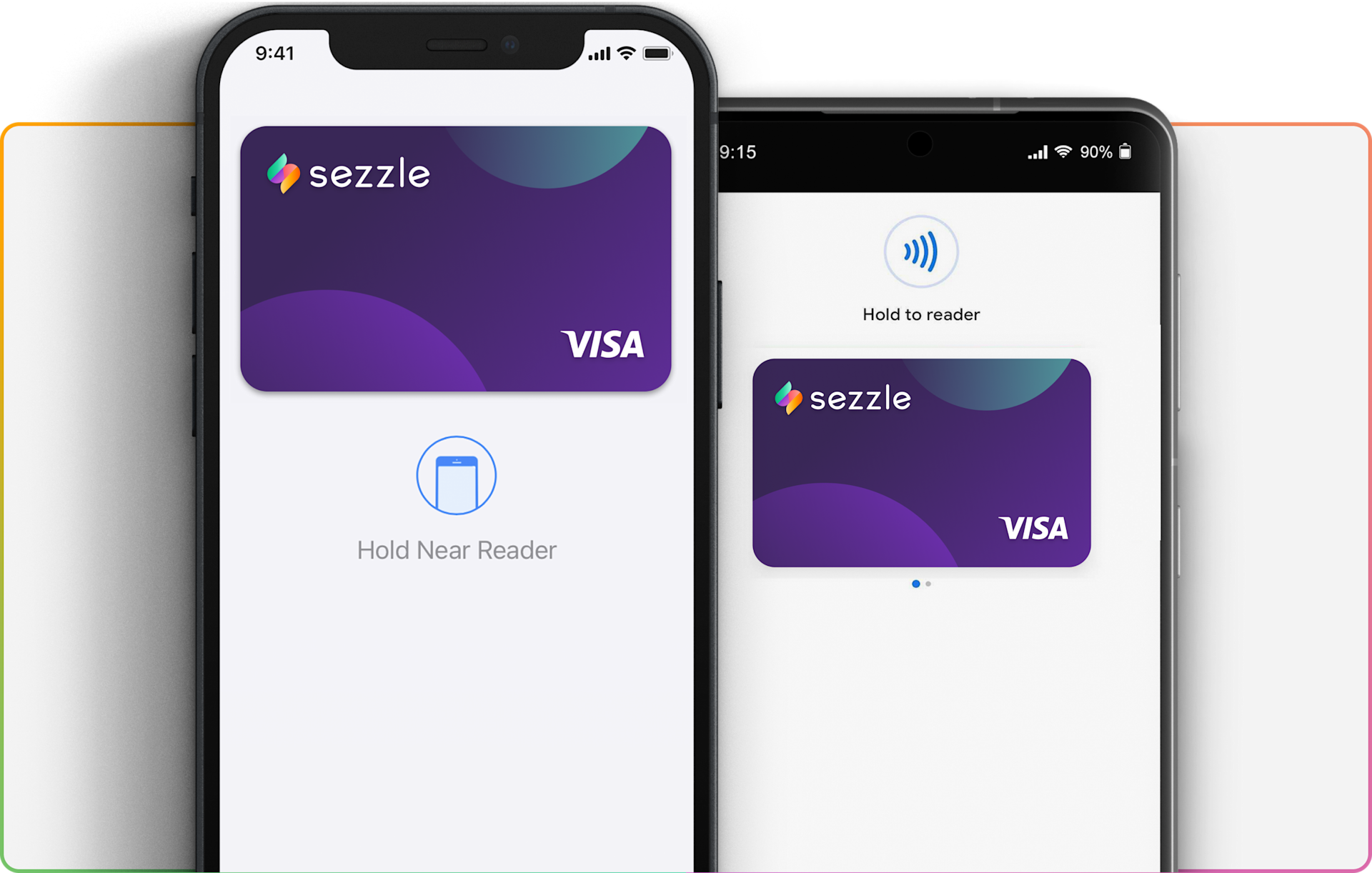

Sezzle also offers a virtual card feature, which allows users to make purchases at non-partner merchants. This virtual card generates a unique 16-digit number, expiration date, and CVV for each transaction, ensuring security and convenience.

Who Accepts Sezzle Virtual Card?

The Sezzle virtual card expands the usability of the service beyond its partner merchants. While it's ideal for shopping at non-partner retailers, it's essential to know which businesses accept this payment method. Below, we explore the types of merchants and platforms that support Sezzle virtual card transactions.

Key Merchants and Categories

- Retailers: Many brick-and-mortar stores and online retailers accept Sezzle virtual card for purchases.

- E-commerce Platforms: Popular platforms like Amazon and eBay may support Sezzle virtual card transactions, depending on the seller's payment preferences.

- Subscription Services: Some subscription-based businesses, such as streaming services and meal kits, allow payments through Sezzle virtual card.

It's important to note that not all merchants accept virtual cards due to security protocols or payment gateway restrictions. Always check with the merchant beforehand to ensure compatibility.

Read also:P Diddy Net Worth 2025 The Untold Story Of Success And Wealth

Major Retailers Accepting Sezzle

Sezzle has partnered with numerous well-known retailers across various industries. These partnerships ensure that users have access to a wide range of products and services. Below are some of the major retailers that accept Sezzle:

Popular Retailers

- Walmart: One of the largest retailers in the world, Walmart offers Sezzle as a payment option for select products.

- Target: Known for its affordable fashion and home goods, Target allows customers to pay with Sezzle during checkout.

- Nordstrom: Luxury shoppers can enjoy Sezzle's installment plan when purchasing high-end fashion items from Nordstrom.

These partnerships highlight Sezzle's commitment to providing flexible payment solutions for a diverse range of consumers.

E-commerce Platforms That Accept Sezzle

In addition to physical retailers, many e-commerce platforms have integrated Sezzle as a payment option. This integration enhances the shopping experience by offering users more financial flexibility. Below are some notable e-commerce platforms that accept Sezzle:

Top E-commerce Platforms

- Shopify: Many Shopify-powered stores offer Sezzle as a payment method, making it easier for small businesses to attract customers.

- Etsy: Independent artisans and crafters on Etsy can accept Sezzle payments, allowing buyers to purchase unique items in installments.

- ASOS: The global fashion retailer ASOS supports Sezzle, enabling shoppers to buy trendy clothing without worrying about upfront costs.

By partnering with these platforms, Sezzle continues to expand its reach and influence in the e-commerce landscape.

International Acceptance of Sezzle Virtual Card

While Sezzle is primarily available in the United States, Canada, Australia, and the United Kingdom, its virtual card offers international shopping possibilities. Users can make purchases from global retailers that accept major credit card networks, as Sezzle's virtual card operates on the Visa or Mastercard network.

However, international transactions may incur additional fees or exchange rate differences. Always review the terms and conditions before using your Sezzle virtual card for overseas purchases.

Benefits of Using Sezzle Virtual Card

Sezzle virtual card provides several advantages for users. Below are some of the key benefits:

Advantages of Sezzle

- No Interest Charges: Unlike traditional credit cards, Sezzle does not charge interest on purchases.

- Flexible Payment Plans: Users can split their payments into four equal installments over six weeks.

- Enhanced Security: The virtual card generates unique card details for each transaction, reducing the risk of fraud.

These benefits make Sezzle an attractive option for those seeking a hassle-free and secure payment method.

Limitations and Considerations

While Sezzle offers numerous advantages, there are some limitations and considerations to keep in mind:

Potential Drawbacks

- Merchant Restrictions: Not all merchants accept Sezzle virtual card, limiting its usability in certain situations.

- Spending Limits: Sezzle imposes spending limits based on user eligibility and payment history.

- Dependent on Credit Approval: Users must pass Sezzle's credit verification process to access the service.

Understanding these limitations ensures that users make informed decisions when using Sezzle virtual card.

Statistics and Trends in BNPL

The buy-now-pay-later industry has experienced significant growth in recent years. According to a report by McKinsey, the global BNPL market is projected to reach $1 trillion by 2025. Sezzle, as one of the leading players in this space, continues to expand its user base and merchant partnerships.

Key statistics highlight the increasing popularity of BNPL services:

- 75% of millennials prefer BNPL over traditional credit cards.

- BNPL transactions accounted for 11% of all e-commerce payments in 2022.

- Sezzle processed over $1 billion in transactions in 2022 alone.

These trends underscore the growing demand for flexible payment solutions and the potential for further market expansion.

Conclusion

Sezzle virtual card offers a convenient and secure way to shop online and in-store. By understanding which merchants and platforms accept this payment method, users can maximize its benefits while enjoying a seamless shopping experience. From major retailers to e-commerce platforms, Sezzle continues to expand its reach and influence in the retail industry.

We encourage you to explore Sezzle's features and consider how it can fit into your financial strategy. Don't forget to share your thoughts in the comments below or explore other articles on our website for more insights into modern payment solutions.