Understanding Fulton County GA tax records is crucial for individuals, businesses, and property owners. Whether you're conducting research, ensuring compliance, or managing financial obligations, tax records play a pivotal role in decision-making. This article provides an in-depth exploration of Fulton County's tax records, offering clarity and actionable insights.

Fulton County, one of Georgia's most populous and economically vibrant areas, maintains a robust system for tracking and managing tax records. These records are not only essential for local government operations but also serve as a valuable resource for residents and businesses. By understanding how these records are organized, accessed, and utilized, stakeholders can better manage their finances and legal responsibilities.

This guide will delve into the intricacies of Fulton County GA tax records, covering everything from their importance to methods of accessing them. Whether you're a homeowner, researcher, or business professional, this article aims to equip you with the knowledge needed to navigate this critical aspect of financial management.

Read also:P Diddy Jay Z The Visionary Powerhouses Of Music And Culture

Table of Contents

- The Importance of Fulton County GA Tax Records

- How to Access Fulton County GA Tax Records

- Types of Tax Records in Fulton County

- The Process of Recording Taxes

- Benefits of Using Tax Records

- Legal Considerations for Tax Records

- Tips for Efficiently Managing Tax Records

- Role of Technology in Tax Record Management

- Common Challenges in Accessing Tax Records

- The Future of Tax Record Systems

The Importance of Fulton County GA Tax Records

Understanding Tax Records in Fulton County

Fulton County GA tax records serve as a fundamental component of the local fiscal system. These records document the financial transactions related to property taxes, business taxes, and other revenue-generating activities within the county. By maintaining accurate and up-to-date records, Fulton County ensures transparency and accountability in its financial operations.

Key Benefits for Residents and Businesses

For residents, tax records provide critical information about property values, tax liabilities, and payment histories. Businesses, on the other hand, rely on these records to assess market conditions, evaluate property investments, and comply with regulatory requirements. Additionally, researchers and analysts use tax records to study economic trends and demographic shifts within Fulton County.

Some key benefits include:

- Improved financial planning for homeowners and businesses

- Enhanced transparency in government operations

- Support for legal and financial decision-making

How to Access Fulton County GA Tax Records

Fulton County provides multiple avenues for accessing tax records, ensuring that residents and stakeholders have convenient options for retrieving information. The county's official website serves as the primary portal for online access, while physical records can be obtained through the Fulton County Tax Commissioner's Office.

Online Access to Tax Records

Residents and businesses can access Fulton County GA tax records through the county's online portal. This platform offers features such as property tax searches, payment histories, and tax bill downloads. To access these records:

- Visit the Fulton County Tax Commissioner's website

- Enter the property address or parcel number

- Review available records and download necessary documents

In-Person Access and Documentation Requirements

For those who prefer in-person access, the Fulton County Tax Commissioner's Office is available during business hours. Visitors are required to bring identification and any relevant documentation, such as property deeds or business licenses. This ensures the security and accuracy of the information provided.

Read also:J Lo And P Diddy A Comprehensive Look At Their Love Story Careers And Legacy

Types of Tax Records in Fulton County

Fulton County maintains a variety of tax records to accommodate the diverse needs of its residents and businesses. These records include property tax records, business tax records, and special assessment records. Each type serves a specific purpose and provides valuable insights into the county's financial landscape.

Property Tax Records

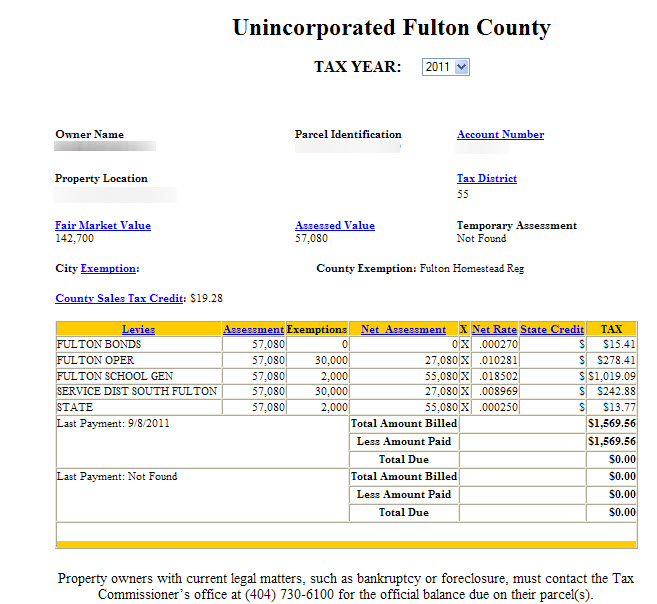

Property tax records document the assessed value of properties, tax rates, and payment histories. These records are essential for homeowners and real estate professionals, offering detailed information about property ownership and tax obligations.

Business Tax Records

Business tax records encompass taxes paid by commercial entities operating within Fulton County. These records include sales tax, income tax, and other business-related levies. Businesses rely on these records for compliance and financial planning purposes.

The Process of Recording Taxes

The process of recording taxes in Fulton County involves several steps, ensuring that all financial transactions are accurately documented and accessible to stakeholders. This process begins with the assessment of property values and continues through the collection and maintenance of tax records.

Property Assessment and Valuation

The Fulton County Tax Assessor's Office is responsible for evaluating property values within the county. This assessment determines the tax liability of property owners and forms the basis for tax record creation. Factors such as market conditions, property improvements, and zoning regulations influence the valuation process.

Tax Collection and Record Maintenance

Once property values are assessed, the Fulton County Tax Commissioner's Office handles the collection of taxes and the maintenance of tax records. This includes processing payments, recording payment histories, and updating records as needed. The office employs advanced technology to ensure accuracy and efficiency in record-keeping.

Benefits of Using Tax Records

Utilizing Fulton County GA tax records offers numerous benefits for individuals and businesses. These records provide valuable insights into property values, tax obligations, and financial trends, enabling stakeholders to make informed decisions.

Financial Planning and Decision-Making

For homeowners, tax records assist in budgeting and long-term financial planning. By understanding their tax liabilities and payment histories, residents can better manage their finances and avoid penalties. Similarly, businesses use tax records to assess market conditions and identify investment opportunities.

Research and Analysis

Researchers and analysts rely on tax records to study economic trends and demographic shifts within Fulton County. These records provide a wealth of data for studies on property values, population growth, and business activity. By analyzing this information, researchers can gain valuable insights into the county's economic landscape.

Legal Considerations for Tax Records

Fulton County GA tax records are subject to various legal considerations, ensuring their accuracy, security, and accessibility. These considerations include compliance with state and federal regulations, as well as the protection of sensitive information.

Compliance with Regulations

The maintenance of tax records in Fulton County adheres to strict legal standards, ensuring compliance with Georgia state laws and federal regulations. This includes adhering to data privacy laws and maintaining secure record-keeping practices. By following these regulations, Fulton County ensures the integrity and reliability of its tax records.

Data Security and Privacy

Protecting sensitive information is a top priority for Fulton County. The county employs advanced security measures to safeguard tax records, preventing unauthorized access and data breaches. These measures include encryption, secure storage, and restricted access protocols.

Tips for Efficiently Managing Tax Records

Effectively managing Fulton County GA tax records requires organization, attention to detail, and the use of appropriate tools. By implementing best practices, individuals and businesses can streamline their record-keeping processes and ensure compliance with legal requirements.

Organizing and Storing Records

To efficiently manage tax records, it is essential to maintain an organized system for storing and retrieving information. This can be achieved through the use of digital tools, such as cloud storage and document management software. Additionally, creating a centralized location for physical records can improve accessibility and reduce clutter.

Utilizing Technology for Record-Keeping

Technology plays a vital role in modern tax record management. By leveraging tools such as online portals, mobile apps, and automated systems, stakeholders can streamline their record-keeping processes. These technologies offer features such as real-time updates, secure access, and customizable reporting options.

Role of Technology in Tax Record Management

The advancement of technology has significantly transformed the way Fulton County manages tax records. From digital platforms to automated systems, technology has enhanced the efficiency, accuracy, and accessibility of tax record management.

Advantages of Digital Platforms

Digital platforms offer numerous advantages for tax record management, including improved accessibility, enhanced security, and streamlined processes. These platforms enable stakeholders to access records from anywhere, at any time, while ensuring the protection of sensitive information.

Future Innovations in Record-Keeping

As technology continues to evolve, Fulton County is exploring new innovations in tax record management. These innovations include the use of blockchain technology for secure and transparent record-keeping, as well as artificial intelligence for automated data analysis. By embracing these advancements, the county aims to further improve its tax record management system.

Common Challenges in Accessing Tax Records

While Fulton County provides multiple avenues for accessing tax records, some challenges may arise for users. These challenges include technical difficulties, limited access to certain records, and the need for specialized knowledge to interpret complex data.

Addressing Technical Issues

Technical issues, such as website outages or software malfunctions, can hinder the accessibility of tax records. To address these challenges, Fulton County regularly updates its systems and provides technical support to users. Additionally, the county offers alternative methods for accessing records, such as in-person visits or phone inquiries.

Overcoming Complexity in Data Interpretation

Interpreting complex tax records can be challenging for individuals without specialized knowledge. To assist users, Fulton County provides resources such as user guides, tutorials, and customer support. These resources aim to simplify the process of accessing and understanding tax records.

The Future of Tax Record Systems

The future of tax record systems in Fulton County looks promising, with ongoing efforts to enhance efficiency, accuracy, and accessibility. By embracing emerging technologies and innovative solutions, the county aims to create a more user-friendly and secure system for managing tax records.

Some anticipated developments include:

- Integration of blockchain technology for secure record-keeping

- Implementation of AI-driven data analysis tools

- Expansion of digital access options for users

Conclusion

Fulton County GA tax records play a vital role in the financial and administrative operations of the county. By understanding the importance of these records, learning how to access them, and utilizing them effectively, stakeholders can make informed decisions and ensure compliance with legal requirements. This comprehensive guide has provided insights into the various aspects of Fulton County tax records, offering valuable information for residents, businesses, and researchers alike.

We encourage readers to explore the resources provided by Fulton County and take advantage of the tools and technologies available for managing tax records. Feel free to share your thoughts and experiences in the comments section below, and don't hesitate to reach out with any questions or inquiries. For more information on Fulton County's services and programs, visit our website or explore related articles on this platform.