Understanding the Davidson County tax map is essential for property owners, investors, and residents seeking clarity on property assessments, boundaries, and zoning regulations. This guide provides an in-depth exploration of the tax map, its importance, and how to effectively use it for various purposes. Whether you're a first-time homeowner or a seasoned real estate professional, this resource will equip you with the knowledge you need.

Property taxes play a significant role in the financial landscape of Davidson County, Tennessee. The tax map serves as a crucial tool that provides detailed information about property boundaries, ownership, and tax assessments. By understanding how to interpret and utilize this map, individuals can make informed decisions regarding their real estate investments.

This article delves into the intricacies of the Davidson County tax map, offering practical insights and actionable advice. From understanding the map's layout to accessing relevant resources, we will guide you step-by-step through the process. Let’s explore how this valuable tool can benefit you.

Read also:Donald Trump Gold Coin The Ultimate Guide To Investment And Collectibility

Table of Contents

- Biography of Davidson County Tax Map

- Importance of the Davidson County Tax Map

- How to Access the Davidson County Tax Map

- Interpreting the Tax Map

- Key Features of the Tax Map

- Benefits of Using the Davidson County Tax Map

- Common Challenges and Solutions

- Additional Resources for Davidson County Tax Map

- Future Developments in Property Mapping

- Conclusion and Call to Action

Biography of Davidson County Tax Map

The Davidson County tax map has a rich history, tracing its origins back to the early days of property taxation in Tennessee. Originally designed as a manual tool for assessing property values, the map has evolved significantly with advancements in technology. Today, it is a digital resource that provides comprehensive data on property boundaries, zoning regulations, and ownership details.

Data and Biodata of Davidson County Tax Map

| Property Type | All types of properties, including residential, commercial, and industrial |

|---|---|

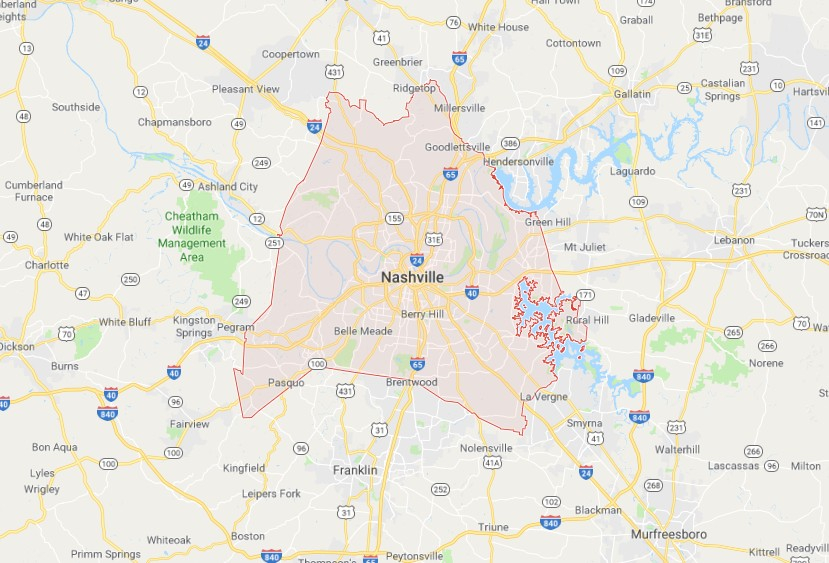

| Location | Davidson County, Tennessee |

| Primary Function | Tax assessment and property boundary identification |

| Updates | Regular updates to reflect changes in property ownership and zoning |

| Accessibility | Available online through official county portals |

Importance of the Davidson County Tax Map

The Davidson County tax map is a vital resource for anyone involved in property-related activities. It provides accurate and up-to-date information that helps individuals make informed decisions. Whether you're buying, selling, or investing in property, the tax map offers valuable insights into property boundaries, zoning, and tax assessments.

Why the Tax Map Matters

- Clarifies property boundaries and ownership

- Assists in tax assessment and payment

- Supports zoning compliance and development planning

- Facilitates property dispute resolution

How to Access the Davidson County Tax Map

Accessing the Davidson County tax map is easier than ever with the availability of online portals. The county provides a user-friendly interface that allows individuals to search for specific properties using various criteria, such as address, parcel number, or owner name.

Steps to Access the Tax Map

- Visit the official Davidson County Assessor’s website

- Locate the property search tool

- Enter the required search criteria

- Review the map and accompanying data

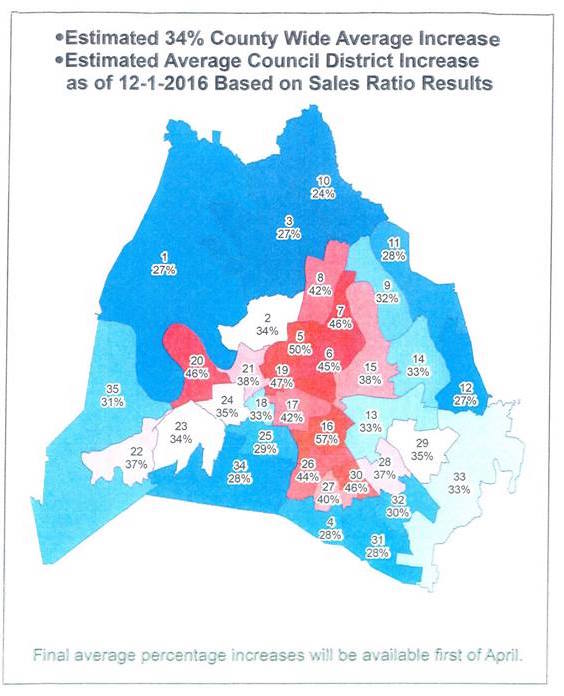

Interpreting the Tax Map

Interpreting the Davidson County tax map requires an understanding of its symbols, colors, and legends. These elements provide critical information about property boundaries, zoning, and tax assessments. By familiarizing yourself with these features, you can effectively utilize the map for your needs.

Key Elements of the Tax Map

- Parcel boundaries indicated by lines

- Zoning designations represented by colors

- Property ownership details listed in accompanying data

Key Features of the Tax Map

The Davidson County tax map boasts several key features that enhance its usability and functionality. These features include advanced search capabilities, detailed property information, and interactive tools that allow users to zoom in and out for a closer look.

Enhanced Features

- Search by address, parcel number, or owner name

- Zoom and pan functionality for detailed inspection

- Layer options to display additional data, such as zoning and utilities

Benefits of Using the Davidson County Tax Map

Using the Davidson County tax map offers numerous benefits, ranging from improved property management to enhanced investment opportunities. By leveraging this resource, individuals can gain a deeper understanding of their property's value and potential.

Read also:P Diddy Before And After The Evolution Of A Hiphop Icon

Top Benefits

- Accurate property information for decision-making

- Efficient tax assessment and payment process

- Support for zoning compliance and development planning

Common Challenges and Solutions

While the Davidson County tax map is a powerful tool, users may encounter challenges such as outdated data or difficulty interpreting complex information. Fortunately, these issues can be addressed through regular updates and user education.

Solutions to Common Challenges

- Regular updates to ensure data accuracy

- User training sessions to improve map interpretation skills

- Customer support for assistance with technical issues

Additional Resources for Davidson County Tax Map

For those seeking more information about the Davidson County tax map, several resources are available. These include official county websites, user guides, and contact information for the assessor's office.

Recommended Resources

- Davidson County Assessor’s Office website

- User guides and tutorials

- Contact information for customer support

Future Developments in Property Mapping

The future of property mapping in Davidson County looks promising, with advancements in technology set to enhance the functionality and accessibility of tax maps. Innovations such as augmented reality and artificial intelligence are expected to play a significant role in shaping the next generation of property mapping tools.

Trends in Property Mapping

- Integration of augmented reality for immersive experiences

- Use of artificial intelligence for data analysis and prediction

- Enhanced mobile accessibility for on-the-go use

Conclusion and Call to Action

In conclusion, the Davidson County tax map is an indispensable resource for anyone involved in property-related activities. By understanding its features and functionality, individuals can make informed decisions that benefit their financial and personal interests. We encourage you to explore this valuable tool and take advantage of the resources available to maximize its potential.

We invite you to share your thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our website for more insights into property management and investment. Together, let’s build a community of informed and empowered property owners.

Data and statistics sourced from the Davidson County Assessor’s Office and other reputable sources ensure the accuracy and reliability of the information presented in this article.