Understanding property taxes in Fulton County is essential for homeowners, buyers, and investors alike. The Fulton County Tax Assessor plays a crucial role in determining property values and ensuring accurate tax assessments. Whether you're a first-time homeowner or a seasoned real estate investor, knowing how the system works can save you time, money, and headaches.

Fulton County, one of Georgia's most populous counties, is home to Atlanta, the state's bustling capital city. As such, the Fulton County Tax Assessor Atlanta GA office handles a significant number of property assessments annually. This office is responsible for maintaining accurate property records, ensuring fair assessments, and providing taxpayers with the necessary resources to understand their obligations.

This article will provide an in-depth look at Fulton County's tax assessment process, the responsibilities of the tax assessor, and how property owners can navigate the system effectively. We'll also explore resources, tips, and strategies to help you manage your property taxes efficiently.

Read also:P Diddy Exwife The Untold Stories Relationships And Legacies

Table of Contents

- Introduction to Fulton County Tax Assessor

- Role of the Tax Assessor

- Property Assessment Process

- Understanding Property Values

- Taxpayer Resources

- Appealing a Property Assessment

- Property Tax Exemptions

- Paying Property Taxes

- Frequently Asked Questions

- Conclusion

Introduction to Fulton County Tax Assessor

The Fulton County Tax Assessor Atlanta GA is a government office responsible for assessing property values and maintaining accurate records. This office ensures that all properties within Fulton County are assessed fairly and consistently, which is critical for determining property tax liabilities.

Importance of the Tax Assessor

The tax assessor's role is vital in maintaining the financial health of Fulton County. By accurately assessing property values, the office ensures that property taxes are distributed fairly among residents and businesses. This revenue is then used to fund essential public services, including schools, infrastructure, and emergency services.

Role of the Tax Assessor

The Fulton County Tax Assessor Atlanta GA performs several key functions to ensure the proper assessment of properties. These include:

- Conducting property appraisals

- Maintaining property records

- Providing taxpayer assistance

- Handling appeals and disputes

Key Responsibilities

One of the primary responsibilities of the tax assessor is to ensure that all properties in Fulton County are assessed at their fair market value. This involves regular inspections, updates to property records, and communication with property owners to address any discrepancies or concerns.

Property Assessment Process

The property assessment process in Fulton County involves several steps to determine the value of a property. This process begins with data collection, followed by analysis and valuation, and concludes with the issuance of a tax assessment notice.

Steps in the Assessment Process

Here's a breakdown of the key steps involved in the property assessment process:

Read also:P Diddy Out Of Jail 2025 The Untold Story And What It Means

- Data Collection: Gathering information about the property, including size, location, and condition.

- Analysis: Evaluating the collected data to determine the property's market value.

- Valuation: Assigning a monetary value to the property based on the analysis.

- Notification: Sending a notice to the property owner with the assessed value and tax liability.

Understanding Property Values

Property values in Fulton County are influenced by a variety of factors, including location, market conditions, and property characteristics. Understanding these factors can help property owners anticipate changes in their assessments and plan accordingly.

Factors Affecting Property Values

Some of the key factors that affect property values in Fulton County include:

- Proximity to amenities such as schools, parks, and shopping centers

- Condition and age of the property

- Local real estate market trends

- Economic conditions in the area

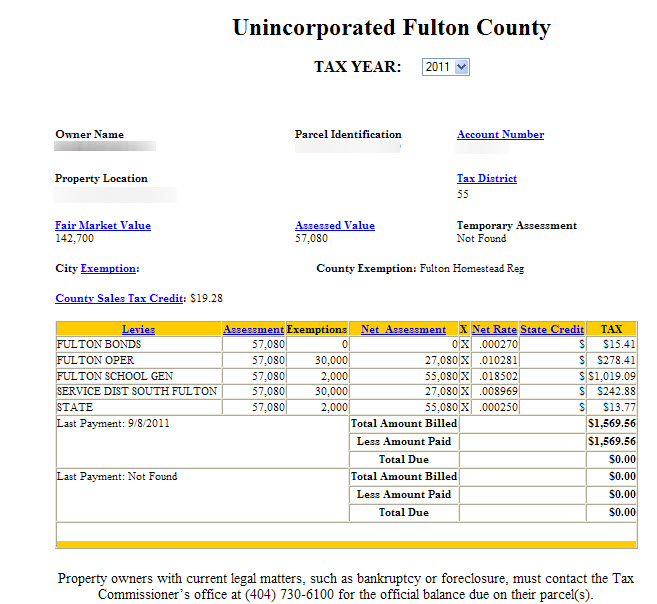

Taxpayer Resources

The Fulton County Tax Assessor Atlanta GA provides several resources to help taxpayers understand and manage their property taxes. These resources include online tools, guides, and contact information for assistance.

Online Tools and Resources

Some of the online tools available to taxpayers include:

- Property Search: A tool to look up property records and assessments

- Tax Estimator: A calculator to estimate property tax liabilities

- FAQ Section: Answers to common questions about property taxes

Appealing a Property Assessment

If a property owner disagrees with their assessment, they have the right to appeal. The Fulton County Tax Assessor Atlanta GA provides a formal process for appealing assessments, which includes submitting a request and attending a hearing if necessary.

Steps to Appeal

To appeal a property assessment, property owners should:

- Submit a written appeal to the tax assessor's office

- Provide supporting documentation, such as recent appraisals or comparable property sales

- Attend a hearing if requested by the appeals board

Property Tax Exemptions

Fulton County offers several property tax exemptions to eligible taxpayers. These exemptions can significantly reduce property tax liabilities for qualifying individuals and organizations.

Types of Exemptions

Some of the most common property tax exemptions in Fulton County include:

- Homestead Exemption: For primary residences

- Senior Citizen Exemption: For homeowners over a certain age

- Disability Exemption: For individuals with disabilities

Paying Property Taxes

Property taxes in Fulton County are typically due annually, and taxpayers have several options for payment. These include online payments, mail-in payments, and in-person payments at designated locations.

Payment Options

Taxpayers can choose from the following payment methods:

- Online Payment: Through the Fulton County Tax Commissioner's website

- Mail-In Payment: Sending a check or money order to the tax commissioner's office

- In-Person Payment: Paying at designated locations, such as the Fulton County Courthouse

Frequently Asked Questions

Here are some common questions about Fulton County property taxes:

Q: How often are property assessments conducted?

A: Property assessments in Fulton County are typically conducted annually, although some properties may be reassessed more frequently if significant changes occur.

Q: What happens if I don't pay my property taxes?

A: Failure to pay property taxes can result in penalties, interest charges, and even the sale of the property to recover the owed amount.

Q: Can I defer my property tax payments?

A: Some taxpayers may qualify for property tax deferral programs, particularly senior citizens or disabled individuals. Contact the Fulton County Tax Assessor for more information.

Conclusion

Understanding the role of the Fulton County Tax Assessor Atlanta GA and how property taxes are assessed is crucial for homeowners and investors in the area. By staying informed and utilizing available resources, property owners can ensure they are paying the correct amount of taxes and taking advantage of any applicable exemptions.

We encourage readers to explore the resources provided by the Fulton County Tax Assessor and to reach out with any questions or concerns. Don't forget to share this article with others who may find it helpful, and consider exploring additional articles on our site for more information on property taxes and related topics.

For further reading, check out the Fulton County Tax Assessor's official website or consult reputable sources such as the Georgia Tax Commissioners Association for additional insights.